cfds represent a popular form of derivative trading that allows investors to speculate on the price movement of various financial markets, such as shares, indices, commodities, and currencies, without owning the underlying asset. It's renowned for giving traders an opportunity to leverage their positions, and with the right strategy, CFD trading can be an impactful component of an investment portfolio.

The Mechanism of CFD Trading

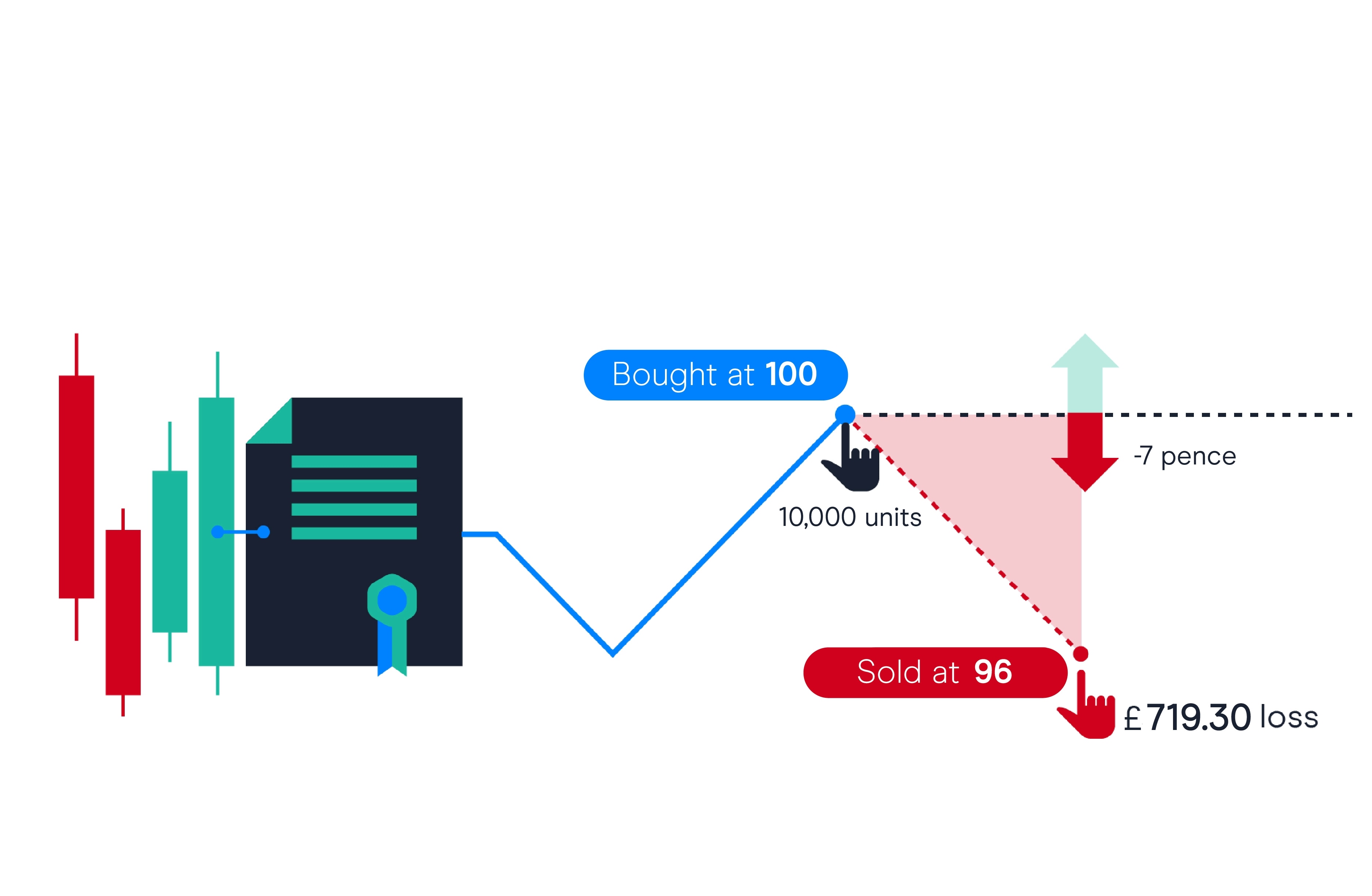

Understanding CFD trading begins with grasping the mechanism behind it. With CFDs, you're essentially entering into a contract with a broker. This agreement stipulates that you'll exchange the difference in value of a financial instrument from the time the contract is opened to when it is closed. CFD trades can go long (you buy) or short (you sell). When you go long, you're keen on the asset's value increasing, and when you go short, you're betting on a decrease.

One of the key elements of CFD trading is leverage, often called margin. This is what allows investors to open a position without committing the full value of the trade. It's important to note that while leverage can magnify profits, it can also multiply losses. This makes risk management a vital component of CFD trading.

CFD Trading and the Underlying Market

As a derivative, CFDs derive their value from the underlying asset. This means that when you open a CFD position on, say, the price of gold, you don't actually own the gold. However, the profit or loss you incur will be based on the market price of gold at the time the contract is opened in relation to when it's closed or settled.

The flexibility of CFD trading is one of its key advantages. You can take quick positions in both long-term investments and short-term trades. Insights into the underlying market are important here. If, for instance, you're trading an index CFD, understanding how macroeconomic events can impact the index's individual stocks is crucial. Similarly, trading a commodity CFD may call for an understanding of supply and demand dynamics.

Managing Risks in CFD Trading

Due to the highly leveraged nature of CFDs, managing risk is of paramount importance. There are several strategies that can aid in keeping risks under control. One common approach is setting stop-loss orders, which automatically close a position if the market moves against you to the extent defined by the order.

Another risk management tool is the limit order, which secures profits by automatically closing the trade when it reaches a specified level of profit. Trailing stops can also be effective, allowing you to protect gains as the market moves in your favor.

It's also beneficial to avoid overleveraging and to trade with a clear plan. This may include setting a maximum percentage of your trading capital that you are willing to risk on a single trade and sticking to it. Developing a trading strategy that aligns with your investment goals and risk tolerance will greatly enhance your experience with CFDs.

CFD Trading and Tax Implications

The approach to taxation with CFD trading varies depending on your jurisdiction. In many cases, CFD trading profits are subject to capital gains tax, but losses may also be used to offset tax liability. It is important for CFD traders to keep detailed records of their transactions and to stay abreast of tax laws in their area to ensure compliance.

In some regions, there are also specific guidelines around CFD trading, including limits on leverage or requirements for broker reporting. Engaging with a tax professional with experience in financial derivatives can help in understanding and managing the tax implications of CFD trading.

Conclusion

CFD trading can be an exciting and potentially lucrative venture, but it's not without risks. By mastering the basics and staying informed, investors can harness the power of CFDs effectively. A solid understanding of the underlying market, paired with sound risk management and tax awareness, can pave the way for a successful CFD trading experience. With the right approach, CFDs can be a valuable addition to any trader's toolkit.

icons at the top right corner of the subsection.

icons at the top right corner of the subsection.